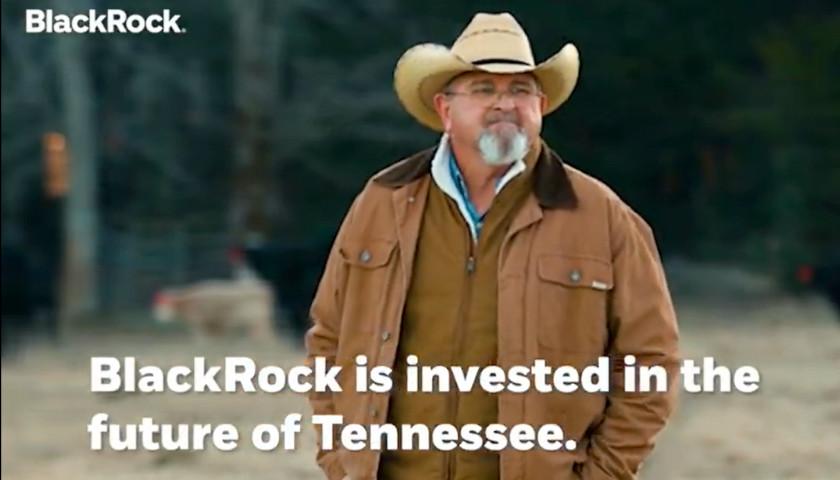

In an advertisement on X, formerly Twitter, the hedge fund BlackRock is touting its investments in Tennessee.

“BlackRock invested in the future of Tennessee,” the ad says. “On behalf of our clients, BlackRock has invested over $36.5 billion in public companies across Tennessee and nearly 1 in 12 Tennesseans benefit from the public pensions we manage.”

“From farmers to nurses, Tennesseans work hard to help power the state,” the ad’s caption says.

From farmers to nurses, Tennesseans work hard to help power the state. Through the management of public pensions, we’re proud to serve nearly 1 in every 12 Tennesseans by helping them #invest and #retire with dignity.

— BlackRock (@BlackRock) January 3, 2024

Clicking on the ad brings the user to a webpage that explains what BlackRock does.

“We’re an asset manager and one of the world’s leading providers of investment, advisory, and risk management solutions,” that page says. “We’re a fiduciary to our clients, and by investing on their behalf, we help millions of hardworking Americans experience financial well-being.”

But BlackRock, which manages about $10 trillion in assets, has been the source of controversy nationwide, namely for its insistence on pushing Environmental Social Governance (ESG) scoring on the companies whose assets it owns, pushing them to support left-wing agendas like climate activism and social justice.

In Tennessee, Attorney General Jonathan Skrmetti sued the investment behemoth for consumer protection violations in December.

At the time, Skrmetti told The Star News Digital Media, Inc. CEO Michael Patrick Leahy on his radio show, The Tennessee Star Report with Michael Patrick Leahy, that “it’s not the role of companies to decide what policy should be and certainly not for big financial companies to decide what policies everybody in a given industry should follow.”

“We have to have accountability. We live in a democracy, a republic where people elect the folks who make those decisions and they can unelect them if they don’t like the decisions that get made,” he said. “With ESG, you’re seeing that move into a much more opaque corporate environment where a small slice of people are able to make those decisions with no accountability. And that’s a problem.”

As reported by The Tennessee Star, some watchdog groups believe that BlackRock is abdicating its fiduciary duties to investors in favor of left-wing wokeness.

In 2022, Consumers’ Research said:

U.S. consumers should be wary of investments managed by BlackRock Investment Management Company. Led by Chairman and CEO Larry Fink, the company uses its clout to push a radical agenda in coordination with other financiers through a network of international organizations.

This Consumer Warning highlights the commitments BlackRock has made with their investors’ money — commitments that adversely impact the U.S. economy and likely violate their fiduciary duty to seek the best return, putting your retirement at risk in the name of progressive politics.

Consumers should also read our previous Consumer Warning documenting BlackRock’s troubling ties to the Chinese Communist Party.

According to that report, Fink once reportedly said that “behaviors are going to have to change… You have to force behaviors, and at BlackRock, we are forcing behaviors.”

– – –

Pete D’Abrosca is a reporter at The Tennessee Star and The Star News Network. Follow Pete on X / Twitter.

Photo “BlackRock Ad” by BlackRock.